Economics

Finance

Policy

Competitive Federalism, Cooperative Federalism, Economic Disparities in India, Economic Growth in India, Foreign Direct Investment (FDI), GST in India, GST Revenue Growth, Gujarat Economy, India Tax Reforms, India’s Growth Potential, Indian Economy, Indian Market Analysis, Indian States GDP, Investment Opportunities in India, Karnataka Economy, Maharashtra Economy, State Competitiveness, State Economic Policies, State-Level Reforms, Urban Governance

AnilMehta

India’s Evolving Federalism: How Competitive Federalism Is Shaping Economic Growth

India’s growth story over the next decade will largely be shaped by its states, each of which presents a unique set of opportunities and challenges. The concept of “competitive federalism” is gradually overtaking the older model of “cooperative federalism,” as states compete for investment, jobs, and resources. This competition is fuelled by India’s diversity—its 28 states and 8 union territories, each with distinct economies, populations, and priorities.

As states aim to attract foreign direct investment (FDI) and drive internal growth, understanding these dynamics is crucial for businesses, policymakers, and international partners looking to engage with India.

Historically, India’s federal system relied on “cooperative federalism,” where the central government and states worked together to address national issues. A prime example of this was the implementation of the Goods and Services Tax (GST) in 2017, where states transferred tax-collection authority to the centre in return for the promise of economic efficiencies and increased revenues.

However, as India has evolved, so has its governance. Today, “competitive federalism” dominates, as states increasingly compete for investments and employment opportunities. Some states, particularly those with favourable geographic locations, large populations, or strong ties to the central government, have reaped significant benefits from this model. For example, Maharashtra and Karnataka, home to major financial and tech hubs, have led the pack in FDI inflows.

This blog post; picks up 3 parameters which GST; GDP and FDI to measure what cooperative federalism did to us and why we need competition fedralism.

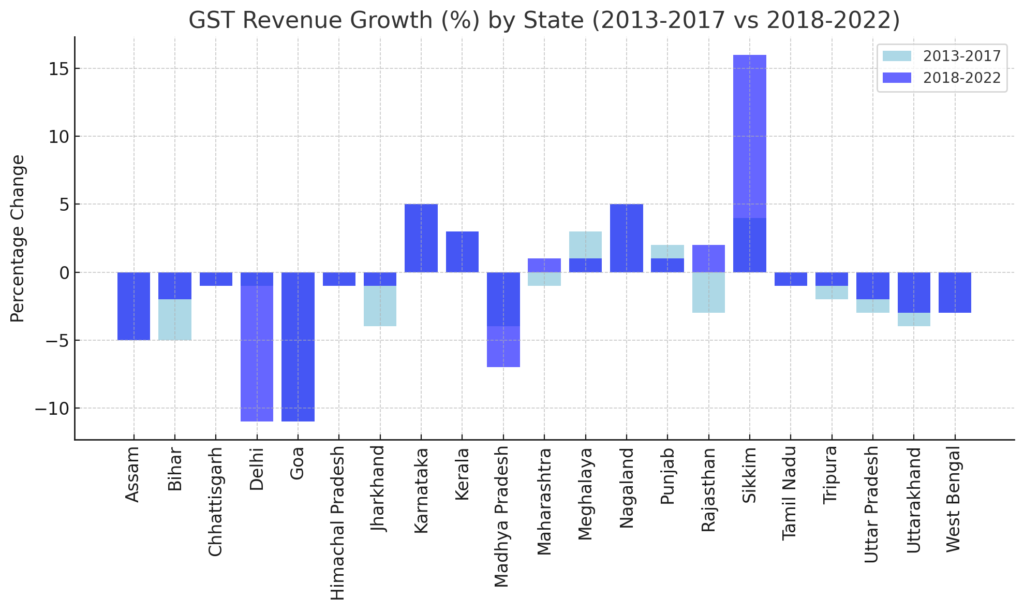

GST Revenue: The introduction of GST was meant to unify India’s tax structure, but it has led to varied impacts across states. Some states have seen significant revenue growth post-GST, while others have experienced a decline. The data shows the percentage change in GST revenue growth across various states for the periods 2013–2017 and 2018–2022. It highlights how different states experienced unequal revenue growth post-GST implementation. For instance, Sikkim experienced the highest growth post-GST (16% in 2018-2022) and states like Assam and Goa continued to experience negative growth (-5% and -11%, respectively).

Similarly, while Maharashtra and Karnataka have shown growth with positive percentages, states like Assam, Bihar, and Uttar Pradesh have experienced declining revenues. Uttarakhand and West Bengal also exhibit a negative trend in revenue growth, further highlighting the need for more customized fiscal policies at the state level to address the disparities brought about by GST implementation. This can be an important consideration in how states navigate the evolving dynamics of competitive federalism. As states continue to compete for investment and job creation, the ability to adapt to policies like GST will be critical in determining their future economic trajectories.

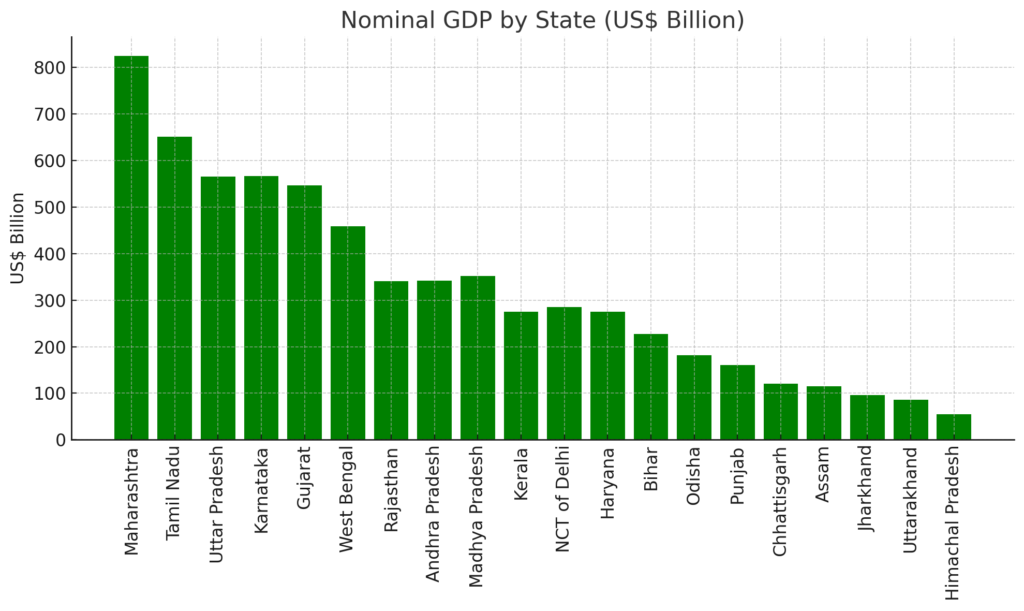

State GDP: This data also clearly indicates that India’s economic trajectory over the next decade will be shaped by the diverse growth trajectories of its states, reinforcing the concept of “competitive federalism.” As states vie for investments and job creation, this competition is evident in the varying economic sizes of India’s regions. Maharashtra, with a nominal GDP of $824.51 billion, leads the pack, followed by Tamil Nadu ($650.34 billion) and Karnataka ($566.66 billion).

These states have pursued distinct policies to attract investment, highlighting how competitive federalism can encourage tailored growth strategies.

On the other hand, smaller states like Uttarakhand ($86.37 billion) and Himachal Pradesh ($55.43 billion) face unique challenges in attracting large-scale investments.

- Top Performers:

- Maharashtra: With a GDP of $824.51 billion, Maharashtra is the largest state economy in India, thanks to its financial capital, Mumbai, and a well-diversified industrial base.

- Tamil Nadu and Karnataka: With nominal GDPs of $650.34 billion and $566.66 billion respectively, these states have strong manufacturing and tech sectors.

- Uttar Pradesh and Gujarat: With GDPs of $565.73 billion and $546.15 billion, they are growth leaders in agriculture and industrialization.

- Mid-tier States:

- West Bengal and Rajasthan: West Bengal’s GDP stands at $458.93 billion, while Rajasthan follows with $340.21 billion. Both states are striving to diversify their economies.

- Kerala and Haryana: With GDPs around $275 billion, these states are improving service sectors and tourism.

- Smaller Economies:

- Uttarakhand and Himachal Pradesh: With nominal GDPs of $86.37 billion and $55.43 billion, they face challenges due to smaller populations and difficult geographies but can leverage natural resources and tourism.

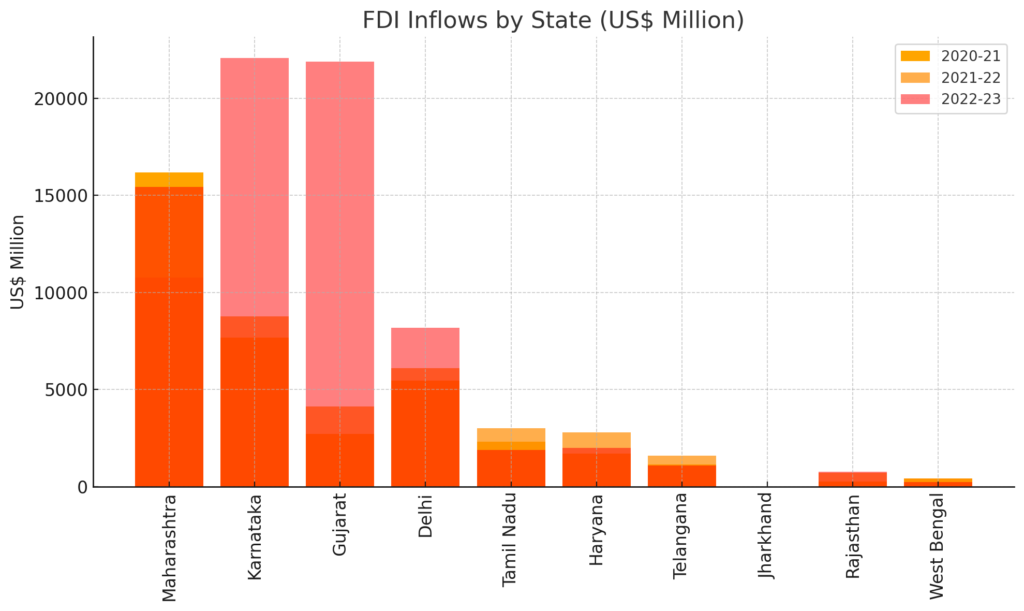

Foreign Direct Investment: FDI is a key driver of economic growth for Indian states, and the competition to attract foreign investment has never been fiercer. Data from 2020-2023 shows stark differences in the ability of states to attract FDI:

The substantial FDI inflows in states like Karnataka (reaching $22,072M in 2022-23) and Gujarat ($21,890M in 2022-23) reflect the success of these states in creating business-friendly environments and policies to attract global investments. In contrast, states like Jharkhand and West Bengal have struggled to attract significant FDI, which indicates that states with favourable policies and infrastructure are more successful in drawing foreign investments.

As India’s states continue to compete for investment and growth, one key area that will need greater focus is city governance. Urban centers like New Delhi, Mumbai, Bengaluru, and Chennai are the engines of India’s economy and will be at the forefront of addressing multigenerational challenges such as climate change, infrastructure development, and the demographic dividend.

However, for cities to rise to these challenges, both the central and state governments will need to devolve more power and resources to municipal bodies. Effective urban governance will be critical in managing last-mile service delivery, ensuring timely development, and responding to emerging global challenges.

A Look Forward: India’s Path to Global Influence

India’s journey toward becoming a global economic powerhouse will depend on how effectively it balances cooperative and competitive federalism. While competition between states will drive innovation and growth, cooperation remains essential, particularly in areas like taxation, infrastructure, and public services. Mutual support and coordination across city, state, and central governments will be critical in achieving India’s long-term goals, including becoming a global manufacturing hub and transitioning to cleaner energy sources.

States that succeed in attracting investment, reforming labour laws, and addressing local challenges will lead India’s economic resurgence. For international businesses, understanding these dynamics will be key to navigating India’s vast and varied landscape.

India’s federal system is at a crossroads. As states compete for resources and investments, the central government must continue to play a crucial role in balancing the interests of high-growth states with those of lagging regions. At the same time, devolving greater powers to city governments will be essential in meeting India’s urban challenges and achieving sustainable growth.

The success of India’s competitive federalism will ultimately hinge on its ability to strike this balance, ensuring that all states and territories can contribute to, and benefit from, the country’s rise on the global stage.

References:

- Department of Promotion of Industry and Internal Trade, Government of India.

- PRS Legislative Research compilation of state government data.

- S&P Global Market Intelligence, 2023.