Economics

Environment

Finance

Policy

Capital Markets India, Central Bank Strategy, Climate Risk South Asia, De-dollarization, Economic Resilience, FDI Strategy India, Financial System India, Foreign Exchange Reserves, Geopolitical Risk, Global Innovation Index, Global Investment Trends, India Economic Analysis, Indian Corporate Funding, Indian Economy, Indian Multinationals, Indian Policy Reform, Innovation Policy, Institutional Reform, Local Currency Settlement, Middle-Income Economies, Monetary Policy India, Productivity Growth India, R&D Spending India, RBI Annual Report 2024–25, Repo Rate Cut, Reserve Bank of India, South Asia Economy, Strategic Reserve Management, Trade Settlement Systems

AnilMehta

India’s Quiet Economic Transition: What the RBI’s Annual Report Really Tells Us

While headlines trumpet the RBI’s calibrated repo rate cuts of 50 basis points, preceded by reductions of 25 basis points—what remains largely unnoticed is the quiet, deliberate effort underway to fortify the economic architecture of India. Beyond the pomp of policy signaling, the central bank is steadily shaping structural resilience against tomorrow’s uncertainties: economic shocks, climate crises, and geopolitical disruptions. This is not just monetary management; it is long-term statecraft through economics.

It’s not just about managing today’s liquidity; it’s about hardwiring resilience for tomorrow.

The Reserve Bank of India’s (RBI) Annual Report for 2024–25 is more than a summary of fiscal metrics and sectoral indicators. Beneath the surface of headlines on record-high surplus transfers, digital currency adoption, and rising household savings, lie deeper signals about the country’s quiet but determined transition into a more complex, resilient, and strategic economy. The insights buried within the report deserve serious reflection—not just by policymakers, but by investors, innovators, and institutions alike.

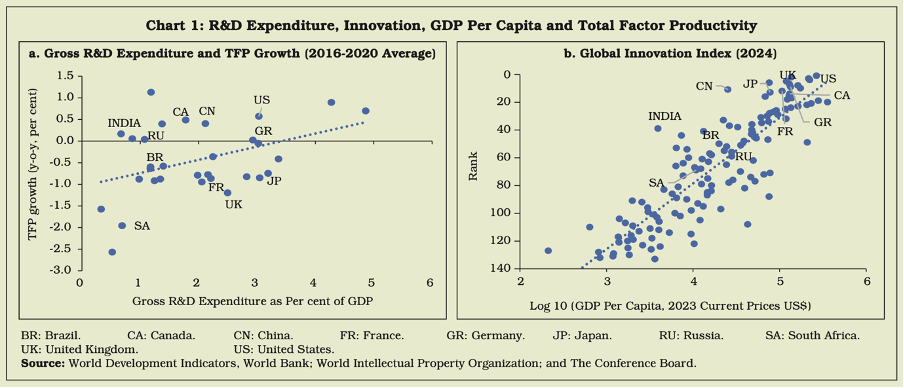

R&D: A Catalyst for Productivity or a Missed Opportunity?

India spends a mere 0.7% of its GDP on Research and Development (R&D)—a fraction compared to Israel (6%), South Korea (5%), or even the OECD average of 2%. While gross R&D expenditure doubled from ₹61,973 crore in 2010–11 to ₹1,27,381 crore in 2020–21, this growth masks a fundamental structural issue: nearly half of this expenditure comes from the government. In contrast, private enterprises in developed economies are the primary R&D drivers.

And yet, this underperformance may paradoxically offer an opportunity. RBI’s study finds that in middle-income countries like India, each percentage point increase in R&D spending yields disproportionately higher productivity gains compared to either low- or high-income economies. India’s manufacturing sector, especially high-tech firms that import advanced inputs and machinery, stand to benefit the most—if innovation systems are put in place to absorb and apply new knowledge.

The missing piece? Institutional frameworks that convert R&D investment into scalable economic value. Without this, we risk losing the momentum reflected in India’s improved position on the Global Innovation Index—from 81st in 2015 to 39th in 2024.

Financial System: From Bank-Centric to Market-Oriented

Another silent transformation is underway in India’s corporate financing model. The RBI’s analysis reveals that large firms are gradually distancing themselves from traditional bank loans. Instead, they are leveraging internal cash flows and accessing market-based funding—issuing bonds, commercial papers, and equity.

COVID-19 seems to have catalysed this transition. Pre-pandemic, growing companies relied on bank credit for expansion. Today, many prefer preserving liquidity and exploring non-bank alternatives. This trend underscores a fundamental shift in India’s financial architecture: a more sophisticated ecosystem, where firms actively manage funding sources, blending bank debt with capital market instruments based on cost and flexibility.

While this enhances resilience, it also places new demands on banks—to recalibrate toward mid-market firms and retail customers, even as large corporates drift toward the capital markets.

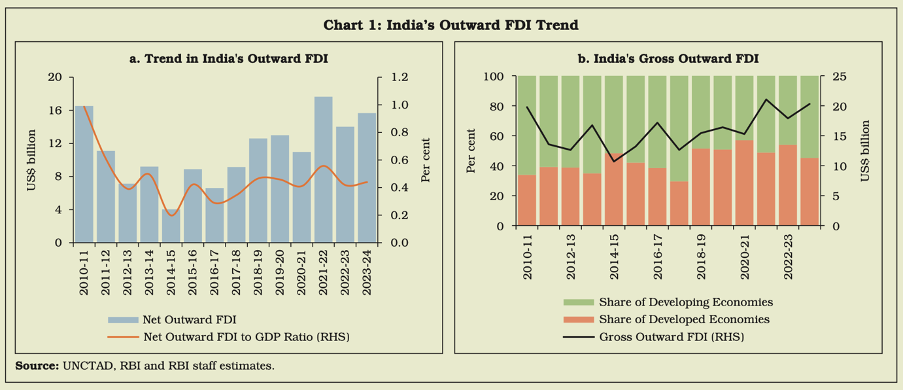

FDI: A Strategic Turn Toward Stability

Perhaps most revealing is the evolution in Indian companies’ Foreign Direct Investment (FDI) behaviour. Between 2019 and 2024, the share of outward FDI targeting developed economies surged to 51.1%, a notable shift from earlier focus on emerging markets. The underlying rationale is sound: larger markets offer not only superior growth potential but also institutional stability.

RBI’s data shows that companies often begin by exporting to a country before investing in it—a measured, stepwise approach to global expansion. Proximity, shared business cultures, and familiarity play a decisive role, as do natural resource considerations in geographies like Africa and the Middle East.

This is not opportunistic globalization. It is strategic positioning—aimed at securing supply chains, diversifying risk, and anchoring growth in stable environments.

Reserve Management: Building Layers of Resilience

In a geopolitically tense world, central banks are rethinking how to manage foreign reserves. RBI’s research reveals that safety, liquidity, and returns—long seen as conflicting priorities—are now being balanced through active diversification. Notably, gold is regaining prominence due to its immunity from sanctions and seizure.

India, like others, is also responding by building multiple layers of protection—spreading reserves across currencies, assets, and jurisdictions. This is more than risk management. It is a hedge against a world where economic shocks are more frequent and warning time is shorter.

Local Currency Trade: A Strategic Hedge

India is also proactively reducing its over-dependence on the U.S. dollar in international trade. Through bilateral frameworks with partners like UAE, Indonesia, Maldives, and Mauritius, the RBI is facilitating local currency settlements that bypass the traditional dollar route. This reduces transaction costs, exchange risks, and exposure to dollar shortages.

More importantly, in a fragmented global order, such systems could act as strategic buffers. In times of crisis, countries with local currency arrangements can keep trade flowing—even if traditional channels falter. It’s a backup plan, and one that reflects India’s growing intent to insulate its trade architecture from global disruptions.

Climate: The Unspoken Economic Risk

Lastly, we cannot ignore the other story the RBI hints at but doesn’t headline—climate vulnerability. South Asia stands among the most climate-sensitive regions globally. Our economies are exposed not only to floods and heatwaves but to their cascading effects on agriculture, urban infrastructure, water stress, and migration.

The RBI seems aware that macroeconomic planning must now factor in climate unpredictability. A warming world will affect productivity, capital allocation, insurance, and even interest rate dynamics. Yet India still lacks the institutional, financial, and physical infrastructure to mount a systemic response.

Quiet Transitions, Strategic Directions

India’s 2024–25 economic narrative, as captured by the RBI’s Annual Report, is not about dramatic leaps but quiet transitions. It tells the story of a country learning to allocate capital more wisely, deploy innovation more productively, access global markets more strategically, and protect its economic interests more defensively.

These are not just data points; they are early signs of an economy maturing—shifting from tactical growth to strategic resilience. Whether in financial plumbing, global integration, or monetary hedging, India is inching toward complexity. The real challenge now lies in institutionalizing these transitions, ensuring they are not just momentary spikes but enduring capabilities.

We are in the foothills of a more confident economic architecture. If we scale wisely, the summit could be more than just growth—it could be stability, innovation, and global relevance.