Economics

Finance

Policy

ATF under GST, cement GST, conclusive land titling, DILRMP, ease of doing business, Export Competitiveness, factor market reforms, Forest Rights Act, GST rate cut, GST rationalisation, India economy, inverted duty structure, land acquisition, land records digitization, land reform, LARR 2013, Make in India, manufacturing costs, MSME credit, natural gas under GST, Section 232 tariffs, SVAMITVA, tenancy reform, Trade Policy, trade sanctions, US tariffs

AnilMehta

Tariff-Proof India: Fix Land, Slim GST

Here’s the uncomfortable truth of August 2025: Indian exporters are being squeezed by a sudden wall of U.S. tariffs, and the instinctive response—wait for a diplomatic fix—won’t be enough. The fastest, surest way to cushion the blow is domestic: finish our long-pending land reforms and rationalise (read: reduce and simplify) GST rates. These two moves lower India’s cost of capital and production, unlock stalled productivity, and make our firms more resilient than any retaliatory tariff list ever could.

Start with the shock. Since June, Washington has doubled “Section 232” duties on steel and aluminium to 50% for most trading partners (the UK is a notable exception). That’s not a rumour—it’s in black and white in a June 3 presidential proclamation, effective June 4. On top of that, the administration has now announced a sweeping 50% tariff on Indian goods under its new “reciprocal tariff” framework, with New Delhi estimating roughly 55% of our shipments to America are exposed. If you want to know why Tiruppur’s knitwear exporters and Mumbai’s jewellery units are panicking, this is it. The U.S. is not a side market: it absorbed about $87.3 billion of goods from India in 2024, making it our single largest destination. (Reuters, The Times of India, United States Trade Representative)

Tariffs, by design, try to raise a rival’s costs. Our counter should be to cut our own. GST rationalisation is the low-hanging fruit. Eight years after rollout, the Council still grapples with too many slabs, needless inversions, and investment-heavy inputs taxed like sin goods. Business groups and professional bodies keep urging a three-rate structure and a phased inclusion of fuels such as ATF and natural gas to end cascading; even the government’s own advisers have acknowledged the case for simplification. While the Council rejected ATF’s inclusion in December 2024, ministers have repeatedly kept it on the table this year. A cleaner, narrower set of lower rates—especially on capital goods and building materials—would immediately reduce working-capital lock-ups and cash-flow stress for exporters caught by U.S. tariffs. (The Economic Times, Reuters, ETEnergyworld.com)

Take cement, the unglamorous backbone of every factory, warehouse, and home. It remains stuck in the 28% GST slab, uniquely penalised among core construction materials. Industry estimates suggest cutting it to 18% would shave 5–8% off typical project costs—exactly the sort of economy-wide relief you want when external tariffs are slamming margins. With public capital spending now the flywheel of growth, taxing cement like a luxury is self-defeating. Rationalise it, and you cut costs across housing, logistics parks, and the manufacturing sheds we expect to backfill lost export demand. (Business Standard, Rediff)

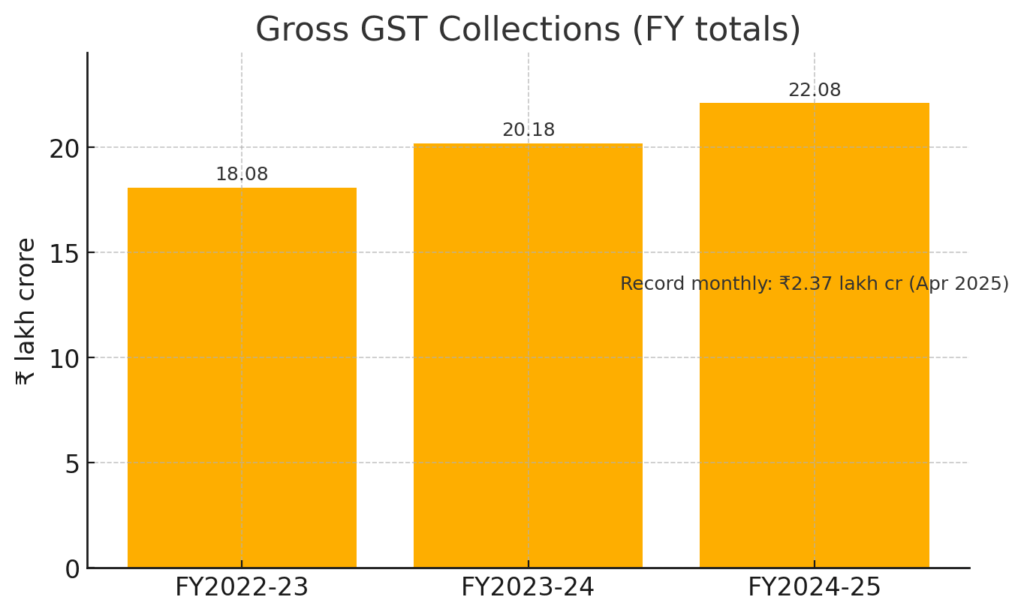

“But can we afford rate cuts?” The revenue data say we have room to calibrate. GST collections hit an all-time high ₹2.37 lakh crore in April 2025, up 12.6% year-on-year—hardly the sign of a fragile base. If we use buoyant months to prune distortionary rates and fix inversions (textiles and electronics are chronic examples), we trade a tiny slice of near-term revenue for broader, compounding efficiency gains—and crucially, for jobs onshore when export orders wobble. (All India Radio News, Reuters)

A GST rate rationalisation isn’t just a supply-side fix; it also boosts middle-class wallets. If the effective weighted GST rate fell by just 1 percentage point (from ~11.6%), the implied reduction in tax take would be about 8.6% of FY25 collections—roughly ₹1.9 lakh crore on the ₹22.08 lakh crore base. Even if only half of that cut is passed through into prices, households would see ~₹95,000 crore of extra disposable income—around a 0.5% lift to annual consumption given PFCE of ~₹203 lakh crore in 2024-25. That immediate breathing room shows up in EMI headroom, durables, travel and eating-out—precisely the middle-class spend that keeps domestic demand resilient when exports face tariffs. (EAC-PM, Press Information Bureau)

The second leg is land. For decades we’ve known the list; what matters now is execution. Abolishing intermediaries in practice (not just in statute), legalising and securing tenancy, enforcing realistic land ceilings, modernising records, consolidating fragmented holdings, protecting tribal land rights, and ensuring fair acquisition and rehabilitation—each speaks directly to cost, credit, and productivity. India’s average operational holding is just 1.08 hectares; fragmentation raises per-unit costs, limits mechanisation, and saps yields. Global and Indian evidence shows consolidation and clear rights improve efficiency—even if effects vary by context. That’s the kind of quiet, compounding productivity we’ll need if a 50% tariff slices into order books. (Press Information Bureau, Frontiers, ResearchGate)

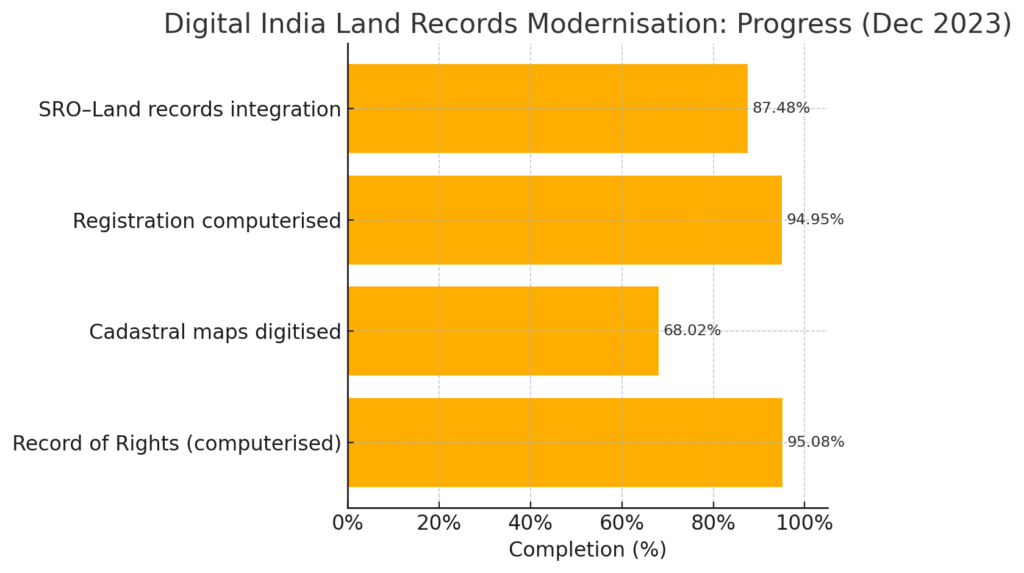

On the “can-do” side, there’s real administrative progress we can build on. Under the Digital India Land Records Modernization Programme (DILRMP), 95% of Records of Rights are now computerised, 95% of registration offices are digital, and 87–89% are integrated with land records. The Unique Land Parcel Identification Number (ULPIN) is being rolled out to over 23 crore parcels. This backbone, if pushed to conclusive titling and integrated revenue courts, can slash disputes, cut transaction times, and unlock land as usable collateral—vital for MSMEs trying to finance production shifts away from tariff-exposed exports. (Press Information Bureau)

In rural habitats, the SVAMITVA programme’s drone surveys and property cards are doing the same for “abadi” land—turning informal homes into bankable assets. As of April 2025, the government reports 2.42 crore property cards created across about 1.61 lakh villages; in January, 65 lakh were e-distributed in a single national push. Those aren’t photo-ops; they are credit and dignity in a plastic card. Finishing this job—uniformly, with high-quality records—means millions more households can finance small enterprises, withstand income shocks, and diversify beyond low-productivity farming. (Press Information Bureau, Press Information Bureau)

Tenancy is the other big unlock. Because leasing is still informal in much of India, tenants lack security and can’t access Kisan credit or crop insurance; landowners, fearing loss of title, leave plots idle or underutilised. NITI Aayog’s Model Agricultural Land Leasing Act (2016) gives states a workable template to legalise and secure leasing, protect both parties, and bring tenancies onto the record—changes that would raise efficiency and equity together. A handful of states have moved; many have not. Completing these reforms turns latent, fearful transactions into productive, bankable ones. (NITI Aayog)

Social justice isn’t a luxury add-on; it’s central to a resilient supply side. The Forest Rights Act is finally seeing renewed implementation momentum—2.51 million titles had been distributed by end-May 2025, roughly half of all claims—yet the coverage, especially of community resource rights, remains uneven. Secure tribal and forest-dweller rights reduce conflict risk around mines, grids, and roads, and improve project timelines—exactly what investors look for when global conditions are adverse. Meanwhile, the 2013 land acquisition law, with its consent, social-impact assessment and generous compensation, should be implemented as written—streamlined where process is duplicative, but not gutted. Certainty and fairness save time; uncertainty and litigation are the real delays. (Press Information Bureau, India Code)

Tie the two strands together and the policy recipe writes itself. Use GST rationalisation to cut the cost of building and operating in India; use land reforms to raise the return on that investment. Bring cement to 18%; fix GST inversions that punish exporters; keep pushing for a three-rate structure while widening the base sensibly over time. In parallel, finish DILRMP to conclusive titles, accelerate SVAMITVA distribution, adopt modern tenancy laws, and protect tribal rights at scale. Do these, and you don’t just blunt the immediate tariff pain; you reposition India for the next cycle with lower domestic frictions, cheaper capex, and faster dispute resolution—the true sources of competitiveness.

There’s a geopolitical case, too. When partners see a rules-based, high-capacity India that reduces its own transaction costs and protects vulnerable communities, it’s easier to build production-sharing deals and easier to rally third markets. But even if trade winds turn unfavourable, a GST-and-land-reform sprint is worth doing on its own merits. The best shield against sanctions and tariffs is growth—broad-based, investment-led, and fair. India can’t control other capitals’ tariff whims. It can, and should, control its own factor-market reform.

References

- Proclamation on Adjusting Imports of Aluminum Articles and Steel Articles Into the United States, June 3, 2025, The White House.

- “India estimates about 55% of goods exported to U.S. will face Trump tariff,” Reuters, Aug. 11, 2025; related coverage on sectoral impacts. (Reuters, The Times of India)

- USTR Country Page: India—U.S.–India goods trade data, 2024. (United States Trade Representative)

- GST collections hit record ₹2.37 lakh crore in April 2025 (All India Radio / NewsOnAir). (All India Radio News)

- “Why cement remains in the 28% GST slab,” Business Standard, Apr. 29, 2025; complementary analysis on cost pass-through. (Business Standard)

- “India may bring ATF under GST soon,” Economic Times – EnergyWorld, Jan. 24, 2025; “GST Council rejects ATF under GST,” Reuters, Dec. 21, 2024. (ETEnergyworld.com, Reuters)

- Digital India Land Records Modernization Programme progress (PIB, Dec. 22, 2023) and DoLR year-end achievements incl. ULPIN coverage (PIB, Dec. 26, 2024). (Press Information Bureau)

- SVAMITVA: “5 Years of SVAMITVA Scheme” (PIB brochure, Apr. 23, 2025); “65 lakh property cards distributed” (PIB, Jan. 18, 2025). (Press Information Bureau, Press Information Bureau)

- Average operational holding size 1.08 ha (PIB note on Agriculture Census). (Press Information Bureau)

- Evidence on consolidation and productivity: Frontiers in Sustainable Food Systems (2024 review); studies on fragmentation in India. (Frontiers, ResearchGate)

- NITI Aayog, Model Agricultural Land Leasing Act (2016). (NITI Aayog)

- Forest Rights Act implementation status (PIB, July 31, 2025). (Press Information Bureau)