Resolving the Grid Bottleneck in India’s NEP 2026 – The ₹200 Lakh Crore Capital Call

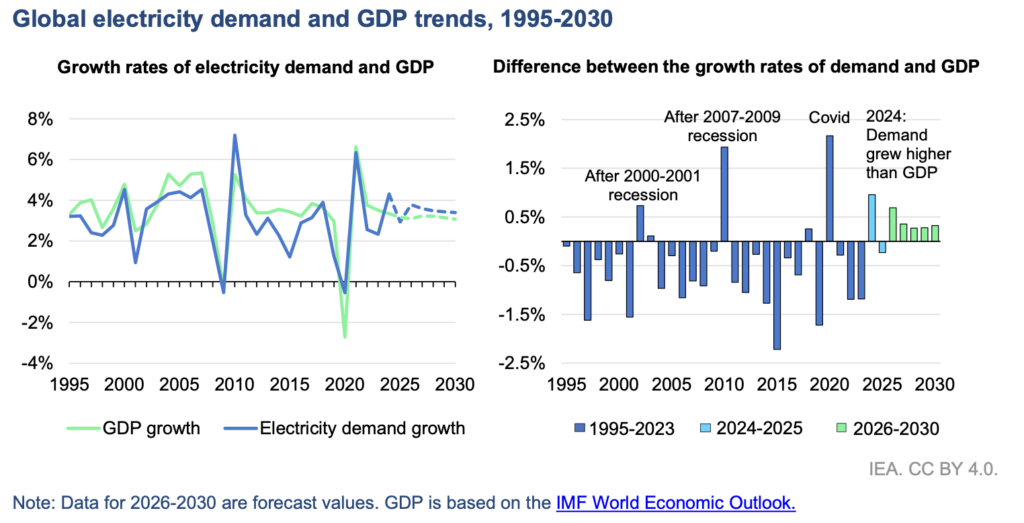

For three decades, energy economists have relied on a comforting heuristic: electricity demand marches in lockstep with GDP. If the global economy grows by 3%, power demand grows by roughly the same. It was a linear, predictable relationship that allowed utilities to plan decades in advance with the dull certainty of a bond coupon.

That relationship is now emphatically broken.

According to the International Energy Agency’s (IEA) latest Electricity 2026 report, we have witnessed a structural rupture. We recently saw the first “normal” year in thirty years—unmarred by a pandemic or financial crash—where electricity demand grew significantly faster than the global economy. This is not a statistical anomaly; it is a phase shift. We have entered what the IEA calls the “Age of Electricity,” a period where power demand is projected to grow 2.5 times faster than total energy demand through 2030.

The implications for capital markets, national infrastructure, and state-level policy are profound. We are no longer just “using” electricity to power the economy; we are physically migrating the entire economy onto an electric foundation. The primary constraint on global and domestic growth in the coming decade will not be labor or capital, but the physical capacity of the wire.

The Two-Speed Surge: Silicon and Sweat

This global demand shock is unique because it is being driven by two diametrically opposed forces: the world’s most advanced digital infrastructure and its most basic human need.

In advanced economies, after fifteen years of stagnation, power demand is suddenly accelerating. The driver is computation. The explosive training needs of Artificial Intelligence (AI) and the steady hum of cryptocurrency will push data center consumption past 1,000 TWh by 2026—roughly equivalent to the entire electricity consumption of Japan. The digital economy now has a very physical, very heavy utility bill.

Meanwhile, in the Global South, and particularly in India, the driver is visceral: heat.

The “temperature sensitivity” of electricity demand is skyrocketing. In states like Uttar Pradesh, the surge in power consumption for every 1°C rise in temperature has increased five-fold since 2017. India is expected to add 570 TWh of new demand over the next five years—more than the United Kingdom consumes in its entirety. This is not just industrial load; it is the sound of millions of new air conditioners turning on to survive a warming planet.

The Supply Miracle: Solar’s Exponential Age

If demand is the crisis, supply is the miracle. We are in the midst of the fastest energy transition in history.

In a single recent year, the world added 620 TWh of solar generation capacity. To put that in perspective, humanity effectively built an entire “Germany” worth of power generation in twelve months, using nothing but photovoltaic panels. Solar has graduated from a niche, subsidized technology to a dominant industrial force. By 2030, renewables and nuclear combined will generate 50 per cent of the world’s electricity.

This has led to a historic milestone: the “Emissions Plateau.” Despite power demand surging, global carbon emissions from the power sector have barely budged. We have finally begun to sever the link between keeping the lights on and burning the planet.

The Great Choke Point: The Queue

However, markets and policymakers must not mistake “Generation Capacity” for “Energy Availability.” Between the solar panel in Rajasthan and the data center in Hyderabad lies the grid—an aging, heavily regulated nervous system that moves at the speed of bureaucracy.

Globally, there are currently over 2,500 Gigawatts (GW) of renewable projects stuck in “connection queues.” These are fully funded, permitted wind and solar farms that are ready to build but are waiting for a slot on the grid. That backlog is larger than the entire installed capacity of the United States and Europe combined.

We are building a Ferrari engine (AI and Solar) and trying to drop it into a Model-T chassis (the Grid). A modern transmission grid takes anywhere from 5 to 15 years to upgrade; renewable generation takes just 1 to 2 years to build. This time mismatch is the single biggest risk to the global economic transition.

India’s Pivot: The Realities of the Draft NEP 2026

This brings us squarely to India’s doorstep and the Ministry of Power’s recently circulated draft National Electricity Policy (NEP) 2026. The draft is highly ambitious, explicitly acknowledging the transformational shift in how we consume power and the urgent need to overhaul our infrastructure to match it.

The NEP 2026 correctly identifies the staggering capital required to fund this new Age of Electricity, projecting investment needs of ₹50 lakh crore by 2032 and a monumental ₹200 lakh crore by 2047. To mobilize this, the policy astutely proposes the establishment of sector-specific funds and a Climate Finance Taxonomy, leveraging institutions like NaBFID and NIIF.

Yet, high-level national targets often encounter severe friction when they hit the ground. Having navigated these exact structural bottlenecks while serving on the Core Committee at the Ministry of Power, and working directly on economic transition initiatives with the state governments of Uttarakhand and Bihar, it is abundantly clear that the energy transition will live or die at the intra-state level.

Consider the realities on the ground in Uttarakhand. The state is actively working to transition from a remittance-heavy “money order economy” into a highly productive economic hub driven by localized tourism, manufacturing, and energy generation. This kind of aggressive, decentralized economic policy hits a hard physical wall if the regional transmission infrastructure cannot handle the new load or integrate variable local renewable generation. Similarly, in states like Bihar, managing rapid, temperature-sensitive demand spikes requires a grid resilience that current legacy distribution networks simply cannot provide.

Escaping the Queue: Three Global Lessons for the NEP 2026

The current draft of the NEP relies heavily on traditional, long-term transmission planning. To truly solve the time-mismatch and clear the queue, India must integrate agile, globally proven regulatory mechanisms into the final policy:

1. Mandate a “Connect and Manage” Framework (The UK Model)

While the draft NEP mandates 5-year transmission plans, it does not fully solve the velocity of capital deployment, which is currently paralyzed by grid connection delays. The policy should mandate a “Connect and Manage” framework.

- The Global Precedent: The United Kingdom pioneered this framework to clear its own massive wind energy backlog. Instead of forcing a wind farm to wait years for “Wider Works” (deep grid upgrades) to be completed, the system operator allows the plant to connect immediately. In exchange, the generator signs a “non-firm” agreement, giving the grid operator the right to curtail the generator’s output during times of severe grid congestion. By adopting this flexible regulation, states can attract capital rapidly rather than watching investment stall while waiting for perfect transmission upgrades.

2. Create a Dedicated Central VGF for Intra-State Grids (Building on India’s BESS Success)

The policy rightly focuses on mobilizing capital through national financial institutions. However, the true bottleneck is at the state transmission and distribution (DISCOM) levels, where utilities lack the balance sheets to fund transformative upgrades.

- The Precedent: India’s Ministry of Finance already uses Viability Gap Funding (VGF) to fund socially vital infrastructure. More recently, the government successfully introduced VGF specifically to help states build Battery Energy Storage Systems (BESS) connected to intra-state grids. The NEP 2026 must take the logical next step: ring-fence a specific VGF mechanism strictly for the physical transmission lines of intra-state grids. This is essential for states trying to rapidly electrify local industries and lift rural economies.

3. Establish Strict Regulatory Categories for AI Load (The Ireland Test Case)

The NEP 2026 promotes AI as an innovative tool, but it must also regulate AI as a massive, continuous consumer of power. The draft must introduce a distinct consumer and tariff category for hyper-scale Data Centers.

- The Global Precedent: Ireland is currently the global test case for this crisis; data centers now consume over 22% of the nation’s total electricity. To prevent rolling blackouts, the Irish regulator recently mandated that new data centers must provide on-site dispatchable generation or massive battery storage. Furthermore, moving towards the US/EU standard of “24/7 CFE Matching”—where a facility must prove it is powered by local clean energy on an hourly basis rather than buying annual offsets—would protect Indian grid stability. Without this, the unchecked proliferation of data centers risks destabilizing local grids and driving up costs for ordinary consumers.

The Capital Call

For investors and policymakers alike, the Age of Electricity signals a permanent pivot in value creation.

The scarcity value in the energy sector has officially shifted from the molecule (coal and gas) to the electron’s path (transmission). Global and domestic investment in grids must rise by at least 50 per cent by 2030. This is the next great infrastructure super-cycle.

Consequently, the era of deflationary electricity prices is likely behind us. While solar generation itself is incredibly cheap, the delivered cost of power must rise to pay for the massive grid upgrades required to move it. Inflation in the 2030s may well be driven by the “System Cost” of electricity.

The physics of the grid is colliding with the metaphysics of the market. The central question for India’s power sector is no longer just how to generate clean electricity, but how quickly we can build the nervous system required to carry it. If the NEP 2026 can be tightened to prioritize grid agility, targeted state-level funding, and smart load management, India will not just survive the Age of Electricity—it will define it.

References & Data Sources

- IEA Electricity 2026 Report: Forecasts regarding 2.5x annual demand growth vs total energy demand; data center consumption surpassing 1,000 TWh.

- IEA Renewables 2025 & Grid Reports: Data on 620 TWh global solar additions and the 2,500 GW global backlog in grid connection queues.

- Draft National Electricity Policy (NEP) 2026, Ministry of Power, Govt of India: Targets of ₹50 lakh crore (2032) and ₹200 lakh crore (2047) capital investment; utilization of NaBFID and NIIF.

- Ofgem (UK) Connect and Manage Policy: Framework guidelines for non-firm grid access to accelerate renewable integration.

- Commission for Regulation of Utilities (CRU), Ireland: Regulatory mandates for data center grid connections and on-site generation requirements.